August 18, 2011

Urban Outfitters (URBN)

Yesterday URBN made a new two year low after a disappointing earnings release. The headlines are "dissonant." Record sales yet lower profits which still exceed analysts' expectations.

Yesterday URBN made a new two year low after a disappointing earnings release. The headlines are "dissonant." Record sales yet lower profits which still exceed analysts' expectations.Urban Outfitters Reports Record Q2 SalesFishing in troubled waters could be profitable. One has to search for the reasons for the drop in gross margin. From the earnings report:

Urban Outfitters profit falls 21%, tops estimates

For the three months ended July 31, 2011, gross profit margin percentage declined by 459 basis points versus the prior year's comparable period. This decline was primarily due to increased merchandise markdowns to clear slow moving women's apparel inventory at both Anthropologie and Urban Outfitters, as well as occupancy deleverage caused by negative comparable store sales. For the six months ended July 31, 2011, gross profit margin percentage declined by 474 basis points versus the prior year's comparable period. This decline was primarily due to increased merchandise markdowns noted above. [highlighting added]and a reason for the drop in operating margins:

For the three months ended July 31, 2011, selling, general and administrative expenses, expressed as a percentage of net sales, increased by 32 basis points versus the prior year comparable period due primarily to ecommerce and related catalog investments. Investments in both technology and in our distribution and fulfillment facilities in Europe also contributed to the increase. For the six months ended July 31, 2011, selling, general and administrative expenses, expressed as a percentage of net sales, increased by 62 basis points versus the prior year comparable period primarily due to ecommerce and related catalog investments. [highlighting added]Do these explanations make sense or are they management double-talk? To me they make sense. Retail is fickle. If they made a mistake in the assortment of merchandise, they must clear it out. In a depressed market the clearance would attract buyers who normally don't buy at Urban Outfitters and that could be the reason for the record revenues. A few years back the company had similar problems when they missed a style change. It knocked the stock down creating a buying opportunity because Urban Outfitters was capable of righting the ship. More important, they were up front about the problem and the plans for the solution.

In addition, direct to customer continues to be the fastest growing channel. Bricks and mortar stores are where you check out new merchandise but once you are familiar with it, you might as well save the trip to the store and order online. Books, music and video can do away entirely with bricks and mortar stores because you can sample these products online. Not so apparel which require a personal inspection. But the function of the stores changes from mass distribution to demonstration and testing units.

Growth Story

Has the growth story ended for Urban? A drop in the stock price is not exciting if Urban Outfitters has stopped being a growth story, an "Emerging Retailer." Again from the earnings report:Urban Outfitters, Inc. is an innovative specialty retail company which offers a variety of lifestyle merchandise to highly defined customer niches through 180 Urban Outfitters stores in the United States, Canada, and Europe, catalogs and websites; 160 Anthropologie stores in the United States, Canada and Europe, catalogs and websites; Free People wholesale, which sells its product to approximately 1,400 specialty stores and select department stores; 51 Free People stores, catalogs and website, 1 Terrain garden center and website and a BHLDN website as of July 31, 2011. [highlighting added]If we accept that market saturation is somewhere between 600 to 800 stores, then both Urban Outfitters and Anthropologie continue to be growth stories.

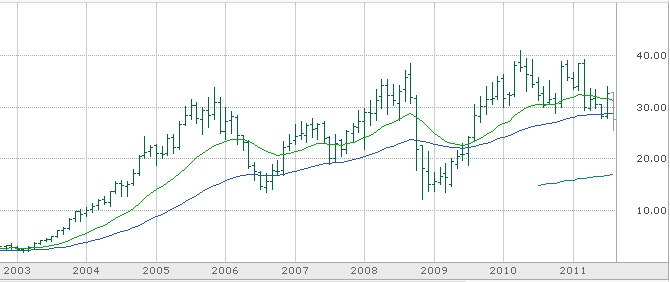

An inspection of the long time price chart is revealing:

URBN was a relatively unknown stock until 2003 when it staged a growth spurt that made it a ten bagger in three years. In 2006 they had the fashion miss I referred to above. That correction was good for a two and a half bagger in two years. Then came the great crash of 2008 which created an even better buying opportunity, a three bagger in eighteen months. I sold most of my shares in June 2010 and sold calls on the rest of them. I have been waiting for developments ever since.

At this point in time we could have another market crash triggered by the dysfunctional euro and that would be a great buying opportunity for URBN, if you still believe their story.

Denny Schlesinger

Urban Outfitters Reports Record Q2 Sales

Urban Outfitters profit falls 21%, tops estimates

Copyright © Software Times, 2000, 2001, 2003. All rights reserved

Last updated March 8, 2009.

Last updated March 8, 2009.