September 6, 2011

The 'Gorilla' Case for MAKO Surgical (MAKO)

Mako RIO Robotic Arm

Denny, what makes you think MAKO is a gorilla in the making? I know those are some strong words coming from you.

Medical Robots

If you are in a rush you might skip this introduction and jump straight to the gorilla argument.Years ago I was very much interested in investing in high tech, an industry that essentially reached its peak for investors around 2000. At the New Paradigm Investing (NPI) and at the Gorilla Game boards we questioned what was next, was high tech over? Yes and no. Our conclusion was that the future prime beneficiaries would no longer be the providers of high tech but the consumers of high tech. This forecast has proven to be quite accurate, many high tech providers have been flat-liners converting themselves from growth to value plays. Consumer electronics was never considered high tech but it is a consumer of high tech, now more than ever. Apple made the transition, most didn't.

Medical robots fall in the category of high tech consumers. It's not just the mechanical part -- which is what gives it its name -- but a considerable amount of digital technology to capture and process data and to help manipulate the mechanical robot. That is not to say that all robots will be economic successes but it is a field worth exploring for investing candidates. My short list includes:

Accuray Incorporated (ARAY) -- CyberKnife

Accuray Incorporated designs, develops, and sells the CyberKnife system, an image-guided robotic radiosurgery system used for the treatment of solid tumors. The CyberKnife system combines continuous image-guidance technology with a compact linear accelerator to deliver high doses of radiation to a tumor from different directions. It tracks, detects, and corrects for tumor and patient movement in real-time during the treatment.

Hansen Medical, Inc. (HNSN) -- Sensei Robotic Catheter

Hansen Medical, Inc. develops, manufactures, and markets medical robotics designed for accurate positioning, manipulation, and stable control of catheters and catheter-based technologies.

Intuitive Surgical, Inc. (ISRG) -- da Vinci

Intuitive Surgical, Inc., together with its subsidiaries, engages in the design, manufacture, and marketing of da Vinci surgical systems for use in urologic, gynecologic, cardiothoracic, general, and head and neck surgeries.

MAKO Surgical Corp. (MAKO) -- RIO & MAKOplasty

MAKO Surgical Corp., a medical device company, markets its advanced robotic arm solution and orthopedic implants for minimally invasive orthopedic knee procedures primarily in the United States.

NuVasive, Inc. (NUVA) -- Maximum Access Surgery (MAS)

NuVasive, Inc., a medical device company, engages in the design, development, and marketing of products for the surgical treatment of spine disorders. Its products are used in applications for spine fusion surgery. The company's products include a minimally disruptive surgical platform called Maximum Access Surgery (MAS), as well as cervical, biologics, and motion preservation products.

Stereotaxis, Inc. (STXS) -- Niobe Magnetic Navigation & Odyssey

Stereotaxis, Inc. designs, manufactures, and markets cardiology instrument control system for use in hospital's interventional surgical suite or interventional lab to treat arrhythmias and coronary artery disease in the United States and internationally.

Wright Medical Group, Inc. (WMGI) -- Implants, not robots

Wright Medical Group, Inc., an orthopaedic medical device company, engages in the design, manufacture, and marketing of devices and biologic products for the extremity, hip, and knee repair and reconstruction. The company also provides surgical solutions for the foot and ankle market.

It is incredibly difficult to know ahead of time which ones will succeed and which ones will fail. In the list above there are two "catheter" companies, STXS and HNSN. In theory STXS has the better product but it is finding adoption slow and difficult because it is expensive and requires the construction of a special X-ray room. As an aside, I was reading about the slow adoption of newer and better aircraft. The problem is that old planes have a useful life of 25 to 30 years and it is not economical to replace them sooner.

MAKO Surgical vs. Intuitive Surgical

I'm not a doctor, I don't play one on TV nor at TMF. I'm mechanically inclined, I like fixing things. From this totally non-medical perspective, I see a huge difference between soft tissue surgery (ISRG) and bone surgery (MAKO). I don't think that the superiority of daVinci over laparoscopic surgery has been conclusively shown. Set-up times are long and outcomes are not necessarily better. But that is not a good reason to make a straight comparison between daVinci and RIO.Knee and hip surgery are as much an engineering problem as a medical problem. I can't address the medical part. The engineering part is alignment, alignment, and alignment. Anyone who has done any joinery work knows that a job without the aid of a jig is seldom if ever as accurate as one done with a mechanical jig. Robots using CAD/CAM are even more accurate than jigs. This, I believe, will be THE reason for MAKO's success. MAKO has already released studies about the accuracy of the alignment of MAKO vs. manual. You might want to research that.

The cynical view is that "widespread adoption" is driven by increased revenues for the hospital. But what creates the incentive? In my opinion: "Eventually, hospitals and clinics are forced to adopt because patients demand them."

But again, that begs the question, "Why do patients want the robot procedure?" I don't think that there is conclusive proof that procedures done with da Vinci are superior. But if a male patient is told that there is a higher probability that his sex life won't be impaired if operated on by a robot, he'll go with the robot. One claim (a valid one) is that the robot removes hand tremor and that is what, I think, makes prostatectomies with da Vinci safer. With MAKO RIO, alignment, a key feature of joint replacement, has been proven to be a lot more accurate than hand procedures. MAKO also claims that less healthy tissue is removed.

One of the objections raised is that the number of partial knee replacements has been traditionally very low in comparison with full knee replacements. In the last conference call, MAKO said that owing to the success of MAKOplasty, based in part on better alignment, more doctors are now recommending earlier partial knee procedures vs. later total knee relacements. In other words, without the robot, partial knee replacement was too dificult and not successful often enough. But that objection is no longer valid.

MAKO is a pre-profitability and some would say "pre chasm" company. As such, as an investment, it is highly speculative. At the same time, I don't think most accounting metrics can be given the same weight as for an established enterprise. Even comparisons with ISRG are difficult. While I don't have documentary evidence for the following statement I believe MAKO IPOed earlier than ISRG did. The only evidence I have is that it took ISRG five years from founding and MAKO four from incorporation. The anecdotal evidence I think I have is that by IPO time, IRSG had more penetration than MAKO did. This might account for MAKO's faster revenue growth, starting from a smaller base.

What I find an important comparative metric is Price to Sales: ISRG 9.63 vs. MAKO 20.55 (at the time this was written some time ago). This tells me that MAKO might be 30 to 50% overpriced but it is also growing much faster which might be the mitigating factor.

The growth figures need to be massaged a bit on account of the dislocation created by the discontinuation of an older product and its replacement with the newer RIO. I moved the deferred revenue for TGS from 2009 back to 2008:

2010 2009 2008

Procedures 17,620 7,550 2,457

Systems 24,928 14,715 11,297

Service and other 1,748 646 487

Revenue 44,296 22,911 14,241

Growth 93.3% 60.9%

2010 is showing Tornado quality growth at 93.3%. Revenue growth for the first quarter 2011 was 80% but for the first time they are reporting a backlog of nine RIO systems to be delivered during the remainder of the year.

Another important metric, MAKO is already profiting more from procedures than from system sales. It took ISRG longer to get to that stage. The importance is that repeat sales of consumables is usually considered a higher quality business than the less certain sale of expensive systems. Which brings me to some other interesting comparative metrics:

da Vinci RIO

Average selling price $1.35 MM $0.85 MM

Revenue per procedure $2,000 $5,000

Cheaper system but the revenue from procedures is two and a half times higher. This was why I was so worried about their implant strategy for hips. Think about it: For 170 RIO procedures (170*5,000) equal one system (850,000). The ratio for ISRG is 675 procedures equals one system. Provided MAKO can keep (or get) its expenses in line with revenues, it should become a highly profitable business.

Looking at the raw numbers, in the last quarter SGA and R&D were eating up operating income and that leaves you with the wrong impression. I added margins to the P&L statement. While the loss widened in absolute terms, it shrank by half in terms of net margin. Provided revenue continues to grow faster than SG&A, profits are around the corner -- say another year.

Also, they have spent a lot of money gearing up for hip which should see triple the volume of knee (with a lower gross margin for the implants). Hip should boost the utilization rate from the current 6.4 per month. 2012 or 13 could see an important inflection point. They plan on launching hip towards the end of this year.

Condensed Statements of Operations Margins

(000, except per share data) (percent)

3 Months Ended 6 Months Ended 3 Months Ended 6 Months Ended

June 30, June 30, June 30, June 30,

2011 2010 2011 2010 2011 2010 2011 2010

Revenue:

Procedures 7676 4240 14143 7868 41.3 41.4 44.7 45.0

Systems - RIO 9474 5672 14838 9062 51.0 55.3 46.9 51.8

Service 1429 339 2624 570 7.7 3.3 8.3 3.3

Total revenue 18579 10251 31605 17500 100.0 100.0 100.0 100.0

Cost of revenue:

Procedures 1716 1111 3514 3066

Systems - RIO 3488 2383 5526 4123

Service 274 177 533 478

Total cost of revenue 5478 3671 9573 7667 29.5 35.8 30.3 43.8

Gross profit 13101 6580 22032 9833 70.5 64.2 69.7 56.2

Op costs and expenses:

SG&A 17137 10717 31946 21535 92.2 104.5 101.1 123.1

R&D 5015 3701 9209 6984 27.0 36.1 29.1 39.9

Dep & amort 977 749 1952 1371 5.3 7.3 6.2 7.8

Total SG&A 23129 15167 43107 29890 124.5 148.0 136.4 170.8

Loss from operations -10028 -8587 -21075 -20057 -54.0 -83.8 -66.7 -114.6

Interest & other income 120 64 212 172 0.6 0.6 0.7 1.0

Loss b. income taxes -9908 -8523 -20863 -19885 -53.3 -83.1 -66.0 -113.6

Income tax expense 1 1 41 47 0.0 0.0 0.1 0.3

Net loss -9909 -8524 -20904 -19932 -53.3 -83.2 -66.1 -113.9

Net loss per share -0.24 -0.26 -0.52 -0.6

Avg common shares outs. 40605 33419 40358 33300

Looking at Intuitive Surgical early years is instructive. They were founded in 1995, IPO in 2000 and profitable in 2004, their tenth year. MAKO's tenth year is 2013. If MAKO grows Gross profit at 80% and Expenses at 50%, profitability starts in 2017

Growth 80% 50%

Year Gross Expenses P/L

Profit

2011 26,123 65,059 -38,936

2012 47,021 97,589 -50,568

2013 84,638 146,384 -61,746

2014 152,348 219,576 -67,228

2015 274,226 329,364 -55,138

2016 493,607 494,046 -439

2017 888,493 741,069 147,424

But this does not take hips into account. A big jump from hips could bring profitability forward to 2014.

Share dilution at ISRG in the early years, until profitability, was rampant!

Year Shares Dilution 2004 33,693 43% 2003 23,626 30% 2002 18,229 2% 2001 17,908 51% 2000 11,898

Currently ISRG shares outstanding stand at 39.29M, making dilution since 2004 3% yearly (I think I got the split data right).

Revenue from procedures

ISRG charges for the tools which have a lifetime of ten uses. MAKO's "tool" is a bur that can't cost all the much but patients literally walk away with the implants.

The 'Gorilla' Case for MAKO Surgical

Geoffrey Moore defined a Gorilla as a company having a product with "Open Proprietary Architecture with High Switching Costs." Applied to high tech this means two things: Competitors are not allowed to copy your system so this is not a commodity market like pork bellies or energy, and second, once you adopt the product it costs a lot in time and money to switch to a competitor's product. Once you are locked into x86/Windows it becomes difficult to use a different chip or a different operating system. Something similar happens with medical robots, once you invest time in learning to use one system, it is going to take a lot of persuasion to learn a new one.In addition there is what is known as "network externality." John McMillan put it succinctly in Reinventing the Bazaar:

"eBay has a competitive edge over rival auction sites, regardless of the design of the auctions, because of what is called a network externality. An auction site is more valuable to a seller if it already attracts more buyers. In turn, buyers go where the sellers already are, which makes the site still more attractive to sellers. Since eBay was there first, the network externality helps make its success self-perpetuating."Competition

At this point, MAKO is in a very strong competitive position. While it is a relatively latecomer, the other entrants in robotic knee surgery were wiped out by the Great Recession, probably for lack of venture financing. Manual knee replacement suffers from lack of proper alignment, at least in partial replacement procedures. Once MAKO has shown that with proper alignment partial knee replacement is a functional solution, many case that before would be put off until they were bad enough for full knee replacement, will now be done sooner as partial replacements. There is one company that has an ingenious competitive product. Instead of a robot, they use 3D printing to produce a customized jig for each patient. Alignment using the jig is improved over what can be achieved without the jig. I have not seen comparisons vs. what can be done with MAKO. Some have suggested that the da Vinci could be a competitor. It is a much more complex robot and was not designed for bone cutting.

At this point MAKO has first mover advantage that it is not likely to lose.

Adoption

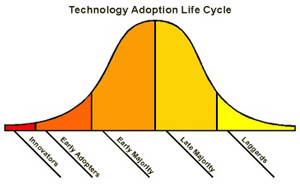

In Gorilla speak, the "Tornado" happens when product flies out the door. Quantified it means growth in the order of 100% on a yearly basis. Revenue grow rate from fiscal year 2009 to 2010 was 93.3% and from the first half of 2010 to 2011 just over 80%. In my book this is close enough to be considered a "Tornado."

Continuing with Gorilla speak, the "Bowling Alley" is the metaphor for adding new markets. The knee "pin" should knock down the hip "pin." In the last conference call management said they expect to launch hip towards the end of fiscal year 2011. Hip replacement is a larger market than knees but the gross margin on the implants promises to be lower because they will not be using an in-house product, at least not initially. The hip market should double MAKO's revenues.

Network Effect

If and when MAKOplasty becomes the standard of treatment, it is likely to garner 60 to 80% of the market. Hospitals will purchase the "best" equipment and more doctors will be trained in its use. Doctors will not want to risk failing with non standard procedures.

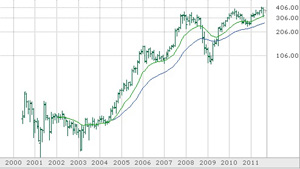

ISRG Logarithmic Price Chart

ISRG Logarithmic Price ChartThe "S" Curve

The price chart of a Gorilla stock and other fast growers looks like the left side of the TALC chart forming a clearly visible "S" curve. The chart on the right is ISRG since its IPO in the year 2000. Not much happened until 2004 when the chart formed the so called "hockey stick curve" which forms the bottom of the "S." The tremendous gains were made in just four years from 2004 to 2007. 2008 forms the top of the "S."I expect something similar to happen with MAKO. 2010 could have been the bottom of the MAKO "S" curve. The fast growth should continue for another four or five years through 2014-15. The important thing to remember is that Gorillas often have 50% corrections which are painful but one should be careful not to sell unless there is a clear indication that the company is derailed.

BTW, the top of the "S" curve is not necessarily a sell signal. A well managed razor and blades business continues to be a cash cow for years to come. The stock transits from "Large CAP Growth" to "Large CAP Value" which can produce a nice income stream in addition to some organic growth.

Denny Schlesinger

Note: This is neither an offer to buy nor to sell securities nor is it professional investing advice. It's only the view from my window. I wish you the best of luck with your investing.

The Gorilla Game: Picking Winners in High Technology by Geoffrey A. Moore (Author)

Copyright © Software Times, 2000, 2001, 2003. All rights reserved

Last updated March 8, 2009.

Last updated March 8, 2009.