May 22, 2009

News, the Economy and Banks

According to The Hitchhiker's Guide to the Galaxy, the only thing that travels faster than light is bad news. Unfortunately, we cannot harness it to send regular news because it only works with bad news. I'm quite sure Douglas Adams came to this conclusion from reading newspapers, their mantra is "only bad news is news." Good news is entertainment, not to be taken seriously. Anyone reading the newspapers should keep this bias in mind. Better yet, don't read the papers. I, for one, don't have a TV set, haven't had one for some 15 years.

I read news very selectively on the Internet, I make sure to filter out the crap. When I run down the list of titles I exclude CNBC, Cramer, and a bunch of others. Why waste time on them?

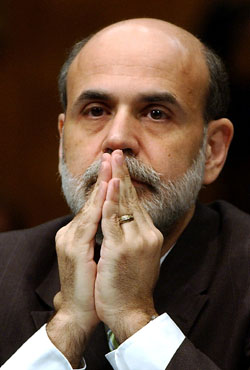

Bernanke praying that the money he printed will be enough to float all the too-big-to-fail banks.

When reading the news, ignore the expert opinions, just follow the money. The greatest danger a bank faces is a bank run. Bank runs are caused by fear, the fear that the bank won't be able to give you back your deposit. In a banking crisis it is vital that the public be lied to, the public must not find out which banks are weak because the ensuing bank runs would collapse them. A bank run can collapse the best run fractional reserve bank because no bank ever has enough money to pay all depositors. One reason why banks don't go to the Fed's emergency loan window (whatever it is called) is because that would identify them as weak and that would start a bank run. To solve this problem, the Fed forced all banks to take taxpayer money, whether they needed it or not. During the depth of the crisis, banks had no choice but to accept.

Read the current news and follow the money. Several banks are trying to return the TARP money and the government is not allowing them to do so. The reason these banks want to return the money is so as not to be under the government spotlight so they can once again pay the executives exorbitant salaries, bonuses and golden parachutes for risking other people's money. If the banks are not in a crisis then there is no crisis any longer except for a couple of giant very badly run banks like City and Bank of America.

Read the current news and follow the money. I have seen quite a few companies float new debt, sell new shares or get into debt for mergers. If credit is flowing there is no crisis.

Denny Schlesinger

Copyright © Software Times, 2000, 2001, 2003. All rights reserved

Last updated March 8, 2009.

Last updated March 8, 2009.