July 11, 2012

MAKOplasty Hits The Chasm

Conference Call Excerpt

On July 9 Dr. Maurice Ferré, MAKO Surgical's CEO, announced that MAKO would miss the systems sales projections for the second consecutive quarter, Q2, 2012. When the bad news came out in May that they missed their system sales estimates the stock took a big hit but I didn't worry about it because a glitch can happen at any time. But two consecutive misses, the second on already lowered expectations, certainly was a sign that something is up. My hunch was a chasm crossing issue. The conference call confirmed my hunch. Dr. Ferré talked about the technology adoption life cycle and the new found delay in selling to certain hospitals he called 'early majority.' Excerpt of Dr. Ferré's remarks:The second quarter continued some of the trends we saw in the first quarter, most notably the results of our RIO sales in Q2 were below our expectations. As we've discussed previously, in our experience, RIO system sales are typically back-end-loaded in any given quarter. As the quarter came to a close, some sales were reasonably expected would close in the quarter, did not.

Hospital interest in our technology remains strong as reflected in the healthy number of qualified accounts in our sales funnel. However, our analysis suggests that as we approach the shift from early adopter phase to early majority phase of the technology adoption life cycle, we are finding that a growing number of potential purchasers require buy-in from a larger number of surgeons to support the return on investment of a MAKOplasty program.

Surgeons' interest in MAKOplasty also remains high as we believe it will continue to grow. We see an increasing attendance at a regularly conducted regional BioSkills training labs which requires a meaningful surgeon time commitment as a leading indicator of the future use of the RIO. Additionally, surgeon interest is more broadly translated into surgeon commitment through visits to existing MAKOplasty sites and an education on the compelling and growing body of clinical evidence supporting MAKOplasty all of which adds time to the RIO sales cycle when involving multiple surgeons per sale.

Having identified this changing profile of our potential hospital and surgeon customers, we are undertaking steps to meet these sales challenges in order to continue to effectively grow our business. We intend to provide additional commentary on our intended solutions on our regularly scheduled earnings call on August 1st.

Technology Adoption, The Chasm and MAKO

What follows assumes the reader is familiar with the Technology Adoption Life Cycle (TALC). If not, I suggest reading Crossing The Chasm first, find the link below.

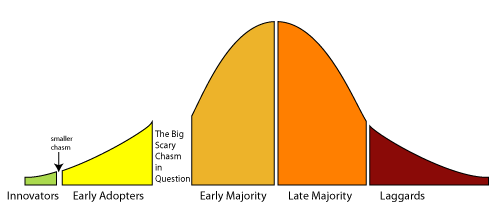

The fundamental marketing insight of the TALC is that technology providers are not dealing with a single market but with five clearly differentiated markets each of which has its own interests and each of which requires a different marketing approach. A product can successfully sell to one group and yet fail to sell to the next one. Moore says there are cracks in the adoption curve, the biggest one between early adopters and early majority, which he calls "The Chasm."

The efforts to market our software in Silicon Valley in the late 1980s failed in the first crack: we got innovators on board but not the early adopters. Had Moore published his book earlier my story might have turned out differently. But I'll leave that to my memoirs, if I ever write them.

One of the difficulties is to figure out where on the TALC a product currently is. Not only are there cracks but also important events like the "Tornado" and the "Bowling Alley" along the adoption cycle. According to Moore the curve approximates a bell curve and the divisions between the groups fall along the standard deviation lines. As a rule of thumb, early and late majority represent around one third each of the total market, innovators and early adopters around 15% and laggards another 15%. MAKO mentioned in the Q&A session that they had covered approximately 10% of their potential market which would put them two thirds of the way through early adopters and starting to target members of the early majority. This matches up well with the other facts surrounding MAKO's performance.

It is to management's credit and to investors' benefit that they have identified the issue facing them as the need to address the concerns of the early majority hospitals: the assurance of acceptable return on investment (ROI). It should be pointed out that MAKO's customers are not the doctors but hospitals and health care organizations. To obtain the desired ROI requires a minimum utilization rate which, in turn, requires that a sufficient number of surgeons buy-in to MAKOplasty. Dr. Ferré said they will divulge this marketing strategy in the regular earnings call on August 1st.

Early Adopters vs. Early Majority

It is worth examining the differences between these two groups. I can't say it any better so let me quote Moore:It turns out our attitude toward technology adoption becomes significant -- at least in a marketing sense -- any time we are introduced to products that require us to change our current mode of behavior or to modify other products and services we rely on. In academic terms, such change-sensitive products are called discontinuous innovations. The contrasting term, continuous innovations, refers to the normal upgrading of products that does not require us to change behavior.In later works Moore referred to this as "switching costs." A technology with high switching costs is hard to displace but it is equally hard to sell initially. Here lies a key difference between early adopters and early majority. The first group sees the immediate advantage to be gained from the new technology and are willing to pay the price of the discontinuity. To continue quoting Moore:

Early adopters ... are people who find it easy to imagine, understand, and appreciate the benefits of a new technology, and to relate these potential benefits to their other concerns. Whenever they find a strong match, early adopters are willing to base their buying decisions upon it. Because early adopters do not rely on well-established references in making these buying decisions, preferring instead to rely on their own intuition and vision, they are key to opening up any high-tech market segment.Later on Moore states that because of these differences, the early adopters do not make good references for the early majority creating a catch-22 situation where the only suitable references for the early majority are the early majority!

The early majority ... are ultimately driven by a strong sense of practicality. They know that many of these newfangled inventions end up as passing fads, so they are content to wait and see how other people are making out before they buy in themselves. They wait to see well-established references before investing substantially.

And that is where MAKO stands today after the first half of 2012 revealed that the early majority is delaying placing the purchase order. What MAKO needs to do now is to break the logjam. If and when that happens we should be on the lookout for the "Tornado."

Conclusion

If we believe the conference call, the only difficulty is training a sufficient number of surgeons per hospital to convince the administrators that the ROI is safe and adequate. If so, the chasm should be easy to cross. But if we believe that members of the early majority are reluctant to be the first to sign on the dotted line, they will come up with other reasons for delaying placing the order.What are the dangers in the delay? It gives potential competitors more time to perfect and submit their offerings. Some people worry about competing robots from larger, well heeled suppliers. I don't believe that is a problem. As Moore states, it's not the product but the category that needs to cross the chasm and the MAKO RIO has a six year advantage. The current adopters would face "high switching costs." A more realistic threat would be a cheaper "disruptive technology," custom made jigs. If the results of using jigs are good enough, likely their lower cost would make them an attractive alternative to robots.

In summary, crossing the chasm is a dangerous, uncertain time for investors.

Denny Schlesinger

The 'Gorilla' Case for MAKO Surgical (MAKO)

Crossing the Chasm: Marketing and Selling Disruptive Products to Mainstream Customers by Geoffrey A. Moore

MAKOplasty BioSkills Training

Copyright © Software Times, 2000, 2001, 2003. All rights reserved

Last updated March 8, 2009.

Last updated March 8, 2009.