August 1, 2012

MAKO, The Whole Product

Thoughts to consider before listening to the August earnings conference call.

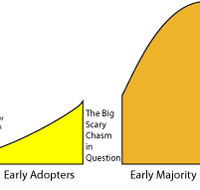

gained the visionary 'early adopters.' In this one I will discuss what is needed to sell to the next market, the pragmatic 'early majority.'

gained the visionary 'early adopters.' In this one I will discuss what is needed to sell to the next market, the pragmatic 'early majority.'I don't intend to write a book review but to understand the marketing challenge one needs to consider four critical ideas presented by Moore: markets, whole product, positioning and sales channels as they apply to TALC.

Markets

Borrowing from my earlier articleThe fundamental marketing insight of the TALC is that technology providers are not dealing with a single market but with five clearly differentiated markets each of which has its own interests and each of which requires a different marketing approach. A product can successfully sell to one group and yet fail to sell to the next one.The visionary early adopters see the new technology as a means of leapfrogging the competition and are willing to jump through hoops to make it happen. By contrast, the pragmatic early majority, while as interested in the new technology, their interest lies in improving the efficiencies of the business but they are not willing to jump through hoops, like the visionaries, to make it happen. In other words, they want a more mature, easier to use product, a whole product.

Whole Product

The following quote from Moore sums it up beautifully:[T]he definition of the whole product is the minimum set of products and services needed to fulfill the compelling reason to buy for the target customer.The 'product' is what comes in the box. The 'whole product' is the ecosystem that has been built around the product to increase its usefulness to the owner. A car without roads, gasoline and spare parts is not useful as transportation but it certainly could be useful as a conversation piece for a collector or as an exhibit for a museum. For the latter two the car itself is a whole product. For the rest of us the car is just a part of the whole product.

The high tech markets Moore writes about have become horizontal value chains with various companies providing the parts of a whole product: Intel makes processor, Dell puts it in a box, Microsoft provides the operating system, and dozens of others supply add-on hardware, software, training and so on. MAKO is much more vertically integrated supplying the robot, the implants and the training for the surgeons. Taking the comments of the last conference call at face value, what is still missing is a sufficient number of trained surgeons to guarantee a sufficiently high usage rate to generate an acceptable return on investment (ROI) for the hospitals.

While the Early Adopters were eager to adopt MAKOplasty as a way to distinguish themselves as leaders to give them an advantage over larger, better funded hospitals, the Early Majority only wants to adopt MAKOplasty once it is considered mainstream and only when they have a sufficiently large staff of surgeons willing and able to use it to generate adequate profits for the hospital. I have been racking my brain trying to figure out what else might be missing of the whole product but, so far, I haven't found what else might be missing.

Positioning

Moore uses the heading "Creating the Competition" but I think "Positioning" is the more comprehensive term. The theory behind positioning is that for each product category people only have space for one or at most two brands. Who was the first person to fly solo across the Atlantic? Most people know it was Charles Lindbergh but very few know who was the second (I don't). The trick, then, is to create a product position where our brand is the undisputed leader. The position has to be credible meaning that it must reference (and top) known competing brands in our case the DaVinci robot and orthopedic surgery. An ideal position for MAKO RIO would be "the DaVinci of orthopedic surgery." This position tells the Early Majority that medical robots are already mainstream and that MAKO is competing with and outperforming older technologies like jigs for aligning the implants.In the case of the implants, MAKO is competing with well known and well liked products from respected competitors. MAKO's implant position might be: "implants designed for robotic procedures" which happens to be the case. MAKO has spent quite a few R&D dollars on making the implants highly compatible with their robotic procedure.

Channels

With the high price of a medical robot and the relatively limited market, the ideal sales channel is a direct sales force which is what MAKO is using in the United States. In the rest of the world MAKO is using distributors and I wonder if it is worth the effort at this point. Moore considers that while crossing the chasm the company should use a LASER sharp focus on the target market with no distractions.One important issue that differentiates MAKO from many high tech products is the repeat business generated by the procedures performed. Even if systems sales fall off, revenue from an increasing number of procedures, at an average of $5,000 per procedure, is a important source of funds to sustain MAKO during these difficult times.

Conference Call

MAKO has pre-announced the disappointing system sales figures for the second quarter 2012 and they promised to address the issues raised by the Early Majority, the market group in focus at this point in the TALC. It should make for an interesting conference call.Denny Schlesinger

Copyright © Software Times, 2000, 2001, 2003. All rights reserved

Last updated March 8, 2009.

Last updated March 8, 2009.