August 19, 2011

ARM Holdings (ARMH)

IBM got out of the PC business soonest. Then high end box maker Compaq went broke and was bought by HP, a move I questioned. Now HP is getting out of the PC business. It clearly marks the next stage in the progression of computing:

IBM got out of the PC business soonest. Then high end box maker Compaq went broke and was bought by HP, a move I questioned. Now HP is getting out of the PC business. It clearly marks the next stage in the progression of computing:- MainframeModern computing devices are made by three groups of companies:

- Mini

- PC

- Server/Mobile

- Chip makersWith the advent of Open Source, making money in software stocks has become even more difficult even as some companies are very successful. My problem with software is that it has become so specialized that I don't understand the stories any more.

- Box makers

- Software houses

The king of box makers today is Apple Inc. (no "computer" middle-name any more). Just because the boxes are cute little portable thingies does not make Apple less of a box maker.

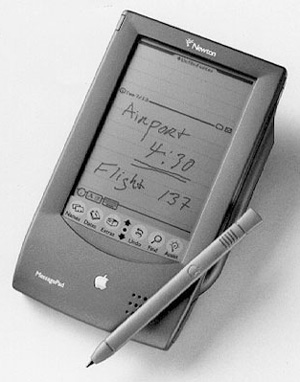

There are many specialized chip makers and the industry is organized as a value chain of designers and merchant fabs, but two names stand out: Intel and ARM Holdings. They are the Gorillas: Intel of servers and PCs and ARM of portables. I first got interested in ARM Holdings (the company, not the stock) when Apple selected them to power the Newton. Ever since I have heard people say that Intel would eat their lunch. But it's ARM Holdings that's nibbling on Intel. The chip business was Intel's to lose and they are slowly losing it, at least in mobile.

There is talk of ARM Holdings developing a low power server chip but that is still in the future. In mobile, of course, power consumption was and is a prime issue. Long battery life is a great plus. In fixed computing, power was not an issue because you could plug yourself into the electric grid. But that too is changing. Most people don't realize the enormous amount of power that server farms consume. The faster you run a server the more heat it generates. The closer you can get them together the faster they get work done. But heat is their enemy so you need huge amounts of extra power to keep server farms (or Internet hotels) cool.

There is talk of ARM Holdings developing a low power server chip but that is still in the future. In mobile, of course, power consumption was and is a prime issue. Long battery life is a great plus. In fixed computing, power was not an issue because you could plug yourself into the electric grid. But that too is changing. Most people don't realize the enormous amount of power that server farms consume. The faster you run a server the more heat it generates. The closer you can get them together the faster they get work done. But heat is their enemy so you need huge amounts of extra power to keep server farms (or Internet hotels) cool. Some years ago Peter W. Huber was warning that the Internet would use a lot of coal. He was mocked but he was right. With the energy crisis getting worse, power consumption in server farms is going to become an issue -- advantage ARM Holdings if they can move their designs up-scale.

I believe the time has come to renew my interest in ARM Holdings and their stock, ARMH. The trigger for me is that Hewlett-Packard is admitting that the PC is no longer cutting edge, the mantle of ubiquity has passed on to mobile computing. Nokia, once the king of cell phones, is struggling against the iPhone as is RIM's BlackBerry. Microsoft has developed an OS for ARM Architecture so it's not Windows only any more. And it's not "Intel Inside" by any means. ARM is even threatening to disrupt Intel in servers. All these developments point to ARMH as an investment opportunity.

I believe the time has come to renew my interest in ARM Holdings and their stock, ARMH. The trigger for me is that Hewlett-Packard is admitting that the PC is no longer cutting edge, the mantle of ubiquity has passed on to mobile computing. Nokia, once the king of cell phones, is struggling against the iPhone as is RIM's BlackBerry. Microsoft has developed an OS for ARM Architecture so it's not Windows only any more. And it's not "Intel Inside" by any means. ARM is even threatening to disrupt Intel in servers. All these developments point to ARMH as an investment opportunity.Researching ARMH is not easy. It's an English company trading ADRs on NASDAQ and they don't file 10-Qs and 10-Ks with the SEC. One has to look at the English version of the reports which are not in US dollars but pound sterling. Some of the terminology is confusing and even if they offer a GAAP version of the reports, twice a year, not quarterly, it is more difficult to make sense out of their financial statements.

Denny Schlesinger

ARM Holdings plc

Copyright © Software Times, 2000, 2001, 2003. All rights reserved

Last updated March 8, 2009.

Last updated March 8, 2009.