August 21, 2011

A LULU of a Bubble

Message Boards are Wonderful

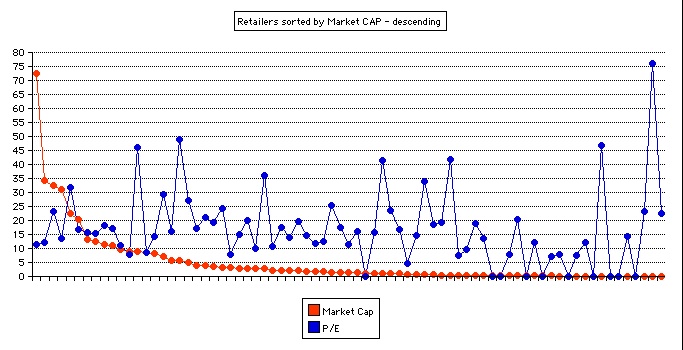

At least, some of them. I posted a short list of stocks to follow which included lululemon athletica inc. (LULU) and I got the following reply from Fool "gibbersome":I would suggest kicking out LULU. GAP's market cap is 8.64B, while LULU's is 5.78B. Retail companies are steady earners, but like GPS, LULU cannot remain a growth story for very long, especially since it is a niche product (other companies sell similar stuff).This comment kicked off a desire to look at comparative Market CAPs to see just how LULU stacks up. Of the 75 retailers on my tracking list, LULU comes in 18th. LULU's has a P/E ratio of 50, the highest after Charles & Colvard Ltd. (CTHR) which is an irrelevant company for our purposes. (Note: WMT's Market CAP on the chart has been divided by 2.5. In reality it is $182 billion)

The high margins LULU has been able to enjoy so far had to do with its products being new. It was a fad that has either reached its peak or passed it. I'm not saying that LULU won't rebound, only that the other stocks on your short list will outperform it.

Eyeballing the chart, it would seem that "better" retailers receive a median P/E ratio of 15 (excluding the outliers) while lower quality retailers receive only around 8 to 10 (excluding the outliers). The dividing line seems to be around a Market CAP of $430 million. Not very scientific, I know.

Sorted by P/E Ratio, this is what the chart looks like: (Note: Again, WMT's Market CAP is not to scale)

LULU is the most "expensive" after CTHR. If WMT can sport a P/E ratio of 11.42 with its huge Market CAP, I think it is fair to say that LULU has a floor of 15 to 20.

Bubbles Are Us

The objection gibbersome has is that LULU is a fad and can't continue to grow forever. Valid comments, both. My experience with retail tells me that unless some untoward event happens, apparel stores saturate the market when they reach about 800 stores not counting international. As of May 1, 2011, LULU had 81 stores in the USA out of a total of 138 stores including Canada and Australia. My rule of thumb says they can grow revenues ten fold or more if they extend their product lines.Simple arithmetic, decreasing P/E ratio from 50 to 15 and increasing revenues ten fold would give a Market CAP of $17.7 billion. Is that reasonable? I dislike the comparison to The Gap (GPS) because it is a chain well past its prime with well over 3,250 stores world wide. Once growth is gone, the P/E ratio drops, in the case of GAP to 8.55. A better comparison might be to Coach, Inc. (COH) with a Market CAP of $13.4 billion and a P/E ratio of 15.74.

The Tipping Point

Malcolm Gladwell has written a very interesting book about fads or social epidemics. In it he talks about the resurgence of Hush Puppies and more importantly the rise and fall of Airwalk, the skateboarding shoes. If you visit skatewarehouse.com men's shoes you won't find any Airwalks!Lululemon's yoga clothes certainly are a fad and, if properly managed, can continue to grow and attract an ever widening audience, as long as management does not screw up. Having read management's discussion of the business in the 10-K, it looks like they are on track to continue fueling the fad. But it bears careful watching.

The Bottom Line

While in investing there are no money back guarantees, my analysis tells me that LULU has multi-bagger potential. Only time will tell if it develops or not.Denny Schlesinger

Form 10-K lululemon athletica inc. January 30, 2011

The Tipping Point: How Little Things Can Make a Big Difference by Malcolm Gladwell

Airwalk

skatewarehouse.com men's shoes You won't find any Airwalks

Data the charts are based on. Source Yahoo!, August 21, 2011.

Symbol Name Market P/E

CAP

WMT Wal-Mart Stores, Inc. Common St 181,590 11.42

TGT Target Corporation Common Stock 34,400 12.19

COST Costco Wholesale Corporation 32,560 23.23

WAG Walgreen Co. Common Stock 31,190 13.56

PCLN priceline.com Incorporated 22,340 31.83

TJX TJX Companies, Inc. (The) Commo 20,490 16.61

COH Coach, Inc. Common Stock 13,380 15.74

BBBY Bed Bath & Beyond Inc. 12,390 15.44

VFC V.F. Corporation Common Stock 11,430 18.27

DG Dollar General Corporation Comm 10,960 17.06

SPLS Staples, Inc. 9,660 11.00

BBY Best Buy Co., Inc. Common Stock 9,000 7.76

CMG Chipotle Mexican Grill, Inc. Co 8,760 46.17

GPS Gap, Inc. (The) Common Stock 8,640 8.55

ROST Ross Stores, Inc. 8,190 14.16

HANS Hansen Natural Corporation 7,040 29.11

FDO Family Dollar Stores, Inc. Comm 5,840 16.22

LULU lululemon athletica inc. 5,780 48.99

ANF Abercrombie & Fitch Company Com 4,940 27.29

URBN Urban Outfitters, Inc. 4,090 17.01

TSCO Tractor Supply Company 3,820 21.05

DKS Dick's Sporting Goods Inc Commo 3,650 19.28

PNRA Panera Bread Company 3,060 24.25

GME Gamestop Corporation Common Sto 3,050 7.87

WSM Williams-Sonoma, Inc. Common St 3,020 14.85

DECK Deckers Outdoor Corporation 2,820 20.17

GES Guess?, Inc. Common Stock 2,810 10.00

UA Under Armour, Inc. Class A Comm 2,720 35.93

BIG Big Lots, Inc. Common Stock 2,260 10.55

CHS Chico's FAS, Inc. Common Stock 2,150 17.47

AEO American Eagle Outfitters, Inc. 2,140 13.85

CROX Crocs, Inc. 2,090 19.70

DSW DSW Inc. Common Stock 1,680 14.64

BKE Buckle, Inc. (The) Common Stock 1,620 11.79

CRI Carter's, Inc. Common Stock 1,610 12.62

PSMT PriceSmart, Inc. 1,560 25.43

CAKE The Cheesecake Factory Incorpor 1,460 17.39

CAB Cabela's Inc Class A Common Sto 1,420 11.53

SHOO Steven Madden, Ltd. 1,330 16.16

BC Brunswick Corporation Common St 1,220 N/A

NDN 99 Cents Only Stores Common Sto 1,170 15.64

BJRI BJ's Restaurants, Inc. 1,120 41.53

BWLD Buffalo Wild Wings, Inc. 1,040 23.48

GCO Genesco Inc. Common Stock 1,000 16.88

ARO Aeropostale Inc Common Stock 865 4.76

TRLG True Religion Apparel, Inc. 687 14.48

PEET Peet's Coffee & Tea, Inc. 677 33.97

RUE rue21, inc. 617 18.60

ZUMZ Zumiez Inc. 534 19.18

RRGB Red Robin Gourmet Burgers, Inc. 441 41.62

GIII G-III Apparel Group, LTD. 427 7.45

HGG HHGregg, Inc. Common Stock 401 9.48

BH Biglari Holdings Inc. 393 13.47

LL Lumber Liquidators Holdings, In 393 18.87

LIZ Liz Claiborne, Inc. Common Stoc 384 N/A

HOTT Hot Topic, Inc. 335 N/A

CBOU Caribou Coffee Company, Inc. 274 7.95

BODY Body Central Corp. 268 20.48

OWW Orbitz Worldwide, Inc. Common S 222 N/A

PETS PetMed Express, Inc. 214 12.08

NWY New York & Company, Inc. New Yo 201 N/A

DEST Destination Maternity Corporati 182 7.30

KIRK Kirkland's, Inc. 176 7.95

CONN Conn's, Inc. 168 N/A

CTRN Citi Trends, Inc. 157 7.64

TUES Tuesday Morning Corp. 147 12.19

ZLC Zale Corporation Common Stock 117 N/A

NATH Nathan's Famous, Inc. 94 46.74

APP American Apparel Inc Common Sto 92 N/A

CWTR Coldwater Creek, Inc. 86 N/A

DAVE Famous Dave's of America, Inc. 76 14.42

CACH Cache, Inc. 67 N/A

ARKR Ark Restaurants Corp. 51 23.04

CTHR Charles & Colvard Ltd 44 76.00

JOEZ Joe's Jeans Inc. 43 22.67

Copyright © Software Times, 2000, 2001, 2003. All rights reserved

Last updated March 8, 2009.

Last updated March 8, 2009.